Retiring from the CSU

-

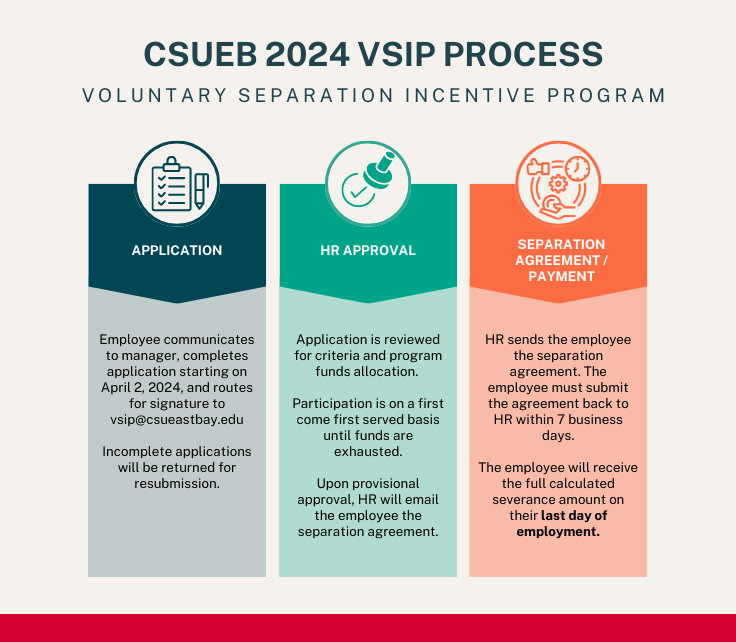

As part of an effort to reduce the structural budget deficit, the university is implementing a voluntary separation incentive program (VSIP) for eligible employees. The 2024 VSIP is to encourage employees to voluntarily separate from the university with a severance package on June 30, 2024. Human Resources will begin accepting applications on Tuesday, April 2 at 8:00AM. The deadline to apply is May 1 at 5:00PM. Complete details of the program can be found here:

VSIP APPLICATION (eForm) Will open on April 2 at 7:45 a.m. Do not submit until 8:00 a.m.

We encourage interested employees to attend the following information sessions:

RETIREMENT SESSIONS:

Life Matters Transition to Retirement - (Zoom)June 6, 2024 11:00am-12:00pmCalPERS:Benefit Basics (Zoom)June 4, 2024 12:00pm-1:00pmJune 19, 2024 10:00am-11:00amYour Retirement Application and Beyond - For members ready to apply for retirement (Zoom)May 30, 2024 9:00am-11:30amFunding Your Retirement Future - For State and California State University Employees (Zoom)June 26, 2024 8:30am-10:00amJune 27, 2024 11:30am-1:00pmHow to Enroll

Log in to myCalPERS and select the Education tab to view class offerings and register. For virtual classes, you can enroll at any of our eight Regional Offices, regardless of your location:

Still have questions after taking a class? Select the Appointment tab in myCalPERS to schedule a one-on-one appointment with one of our specialists. Learn about available appointment types by visiting our Make an Appointment page.

Please direct all questions to Human Resources at vsip@csueastbay.edu

-

Emeritus Staff Eligibility Process ___________________________________________________________________________

Emeritus Staff Eligibility Process ___________________________________________________________________________ Eligibility for Emeritus Staff Status

Employee Type

- Management Personnel Plan (MPP) Employees

- Confidential Employees

- Represented Employees in the following bargaining units: R01, R02, R04, R05, R06, R07, R08, R09, R11

Service to the University

The employee must have at least ten years of service to Cal State University East Bay. Those years shall be continuous except for leaves consistent with policies outlined in the Collective Bargaining Agreements and Chancellor’s Office technical letters and guidelines.

Significant Contribution to the University

The title of emeritus may only be granted to an employee who has made a significant contribution to the University. The employee’s Appropriate Administrator makes this determination in consultation with other members of the campus management team who have knowledge of the employee’s work and shall write a recommendation letter outlining examples of the employee’s contribution to the University.

Privileges of Staff Emeriti

Employees granted Emeritus Staff status will have the following privileges:

- Identification in campus records as Emeritus Staff

- Access to the Library

- Campus Identification card

- Eligible for Get Fit Stay Fit participation

- Continued employee rate for campus sponsored Athletic, Music and Theater events

- Per approval by department, eligibility to volunteer for university functions

Process to Request Emeritus Staff StatusComplete the Emeritus Staff Recommendation Form

The employee’s Appropriate Administrator (or designee) must complete the Recommendation Form and forward, along with a Recommendation Letter, for review and approval.

Write a Recommendation Letter

The employee’s Appropriate Administrator must write a letter of recommendation that includes the rationale for the request and examples of the employee’s contributions to the University. This letter, along with a completed Recommendation Form, is then forwarded for review and approval. The Dean or AVP, as well as the Provost or Division Vice President, may write additional letters to include in the recommendation.

Step-by-Step

- Appropriate Administrator (or designee) completes Section I of the Recommendation Form

- Appropriate Administrator writes and attaches Recommendation Letter

- Form and Recommendation Letter are routed to Dean/AVP for review and completion of Section II; Dean/AVP may attach additional Recommendation Letter

- Approved form and Recommendation Letter are routed to Provost/Division VP for review and completion go Section III; Provost/Division VP may attach additional Recommendation Letter

- Approved form and Recommendation Letter are routed to HR for review

- Approved form and Recommendation Letter(s) are routed to President’s Office for review

- President’s Office completes Section IV and notifies Appropriate Administrator and Employee of decision

a. If Emeritus Status is approved, President's Office notifies HR to update records -

1 + Years Before Retiring

- Watch the CalPERS Planning Your Financial Future video series.

- Use the Planning Your Financial Future Checklist as a guide.

- Visit the Social Security & Your CalPERS Pension page to learn how your Social Security benefits may be affected.

- Estimate the cost of purchasing additional service credit using the CalPERS Service Credit Cost Estimator. If you submit a request for cost to purchase service credit, CalPERS will provide you with a cost election package and a timeframe for you to respond. You must respond within the specified timeframe to purchase the service credit. CalPERS must receive your election form to purchase service credit in advance of your retirement date. Election form(s) received after your retirement date will not be accepted.

1 Year Before Retiring

- Use the Retirement Estimate Calculator or log in to myCalPERS to estimate your monthly benefit.

- Enroll in a CalPERS Member Education classes.

- Contact CalPERS at 1-888-225-7377 if you have a community property claim on your retirement benefits. You must provide us a copy of the court order resolving the claim before you can receive retirement and/or health benefits.

9 Months Before Retiring

- If you're also a member of another public retirement system in California, there are steps you need to take to ensure you receive all your earned benefits from each system. Refer to When You Change Retirement Systems (PUB 16) (PDF) for more information.

6 Months Before Retiring

- Request an Estimate Letter of your potential CalPERS retirement benefit amount. You may choose a retirement date up to one year into the future. You may request up to two CalPERS-calculated Estimate Letters per 12-month period.

- Log in to myCalPERS.

- Go to the Retirement tab, then select Retirement Estimate Calculator.

- Choose Start a New Estimate or one of your Saved Estimates.

- Once you've reached the Estimate Results page, simply select Start Estimate Letter Request.

5 Months Before Retiring

- Begin to gather and make copies of the required documents you'll need to submit with retirement application.

- After taking a Member Education class, Make an Appointment with CalPERS if you need more information or assistance with your retirement paperwork.

- Find out about the taxability of your retirement allowance from the Internal Revenue Service and/or State of California Franchise Tax Board, or your tax consultant or attorney.

3-4 Months Before Retiring

- Submit your completed retirement application and the required documents to CalPERS. Your application can be submitted in person at one of the Regional Offices, by mail, or online by logging in to myCalPERS. Be sure to keep a copy of all the documents submitted for your own record.

- Check with your credit union, employee organization, or insurance plan to see if certain types of payroll deductions can be continued into retirement.

30 Days Prior to Retirement

- Work with your department to complete the Separation Clearance Process.

- Ensure your current address is on file for W-2 and warrant purposes.

1-4 Months After Retirement

- After your retirement calculation has been determined, CalPERS will send you a First Payment Acknowledgment letter, including the date of your first retirement check, amount you can expect to receive, and important income tax information. If you have CalPERS health coverage, a letter will be sent to you with information regarding these benefits. Keep these letters with your other CalPERS information and important financial papers.

- If you didn't retire on the first of the month, your check will cover the period from your retirement date to the end of the month. Afterwards, CalPERS will direct deposit or mail your retirement check on the first of the month. Your financial institution will determine when your funds are available.

- In most cases, you should receive your first retirement check around the first of the month following your retirement date.

- You'll also receive an Account Detail Information sheet providing you with information on what's included in your retirement calculation based on the payroll and service credit information that was posted to your account at the time your benefit was calculated.

- You'll receive a Notification of Deductions letter if you're having deductions taken or making payments for a service credit purchase or mandatory adjustments to your account.

-

The earliest possible retirement date is the day following an employee’s last day on pay status. Retirement may be effective any day of the week; if an employee separates on Friday, retirement may be effective on Saturday.

If an academic year employee receives their paychecks spread out over twelve months and retires immediately following the end of the academic year (6/1), instead of when their paychecks normally run out (9/1), they will start collecting their retirement pay earlier and will receive the pay earned during the academic year as a settlement check sometime in June.

Academic employees should determine which date is more advantageous, 6/1 or 9/1. For some, it might be better to remain on payroll through the summer months due to a various factors such as additional service credit or attaining a birthday quarter. Other employees will benefit more from collecting retirement pay during the summer.

Cost of Living Adjustment (COLA)

If you're planning to retire at the end of the year or at the beginning of the next year, you should consider the cost of living (COLA) adjustment. The COLA is applied to the retirement allowance on May 1 of the second calendar year following retirement. For example:

If you're retirement date is... Then you become eligible for COLA on... December 31, 2024 May 1, 2026 January 1, 2025 May 1, 2027 -

CalPERS Quick Tips: Retirement Estimate Calculator

Interested in knowing how much money you can expect to take home in retirement?

Watch the video below.

You may use the Retirement Estimate Calculator or log in to myCalPERS and select Retirement/Run an Estimate to estimate your monthly benefit.

-

Any unused sick leave is automatically converted to additional service credit if the employee retires within 120 days of separation.

Eight hours of sick leave equals one day (.004 of a year of service). It takes 250 days (or 2,000 hours) of sick leave to receive one year of service credit. For example: An employee with 180 days of sick leave would have .72 years of service credit (.004 x 180).

Your initial retirement checks will not include the sick leave calculation. It may take CalPERS up to 90 days to process and for the adjustment to be included on your retirement check.

-

When you retire, your accrued vacation will be paid out to you; however, have the option to request tax deferral of your lump sum vacation payout to your current 401(k), 457 or 403(b) account(s).

You are eligible to transfer up to the maximum contributions limit

minus the amount you have already contributed for the plan.If your separation date is on or after November 1, you have the option to make the transfer for the current and following tax year, up to the maximum annual contribution limits.

If you are considering this option, you may contact Tony Tijero, Director, Benefits & Payroll, at tony.tijero@csueastbay.edu 30-45 days prior to your separation from the University.

-

CSU post-retirement medical and dental benefits are available to employees (and their eligible dependents) who retire within 120 days of separation from employment. If you retire less than 30 days after your separation, your medical coverage will continue automatically.

The cost of medical coverage will depend on several factors. If you are under the age of 65, you may continue on the same plan that you had as an active employee and you will pay the same premium. If you are over 65 or your spouse is over 65, you will work with the Social Security Administration for enrollment in Medicare and with CalPERS to enroll in a Medicare supplement plan.

PLEASE NOTE: Faculty (Unit 3) employees hired by the CSU and who become members of CalPERS on or after July 1, 2017, must have 10 years of service credit with CalPERS to be eligible to enroll in CalPERS Retiree Medical Benefits and CSU Retiree Dental Benefits. Also, a new retiree health and dental 10-year vesting period went into effect for employees hired by the CSU and who become new CalPERS members on or after July 1, 2018.

If you are enrolled in the Enhanced DeltaCare HMO or Delta Dental plans, your coverage as a retiree will change to the Basic level. Currently the CSU pays the full cost of the Basic level dental coverage for eligible retirees and their eligible dependents. You also have the option to continue with the Enhanced dental coverage for a small monthly cost. To compare the two plans, please review the Dental Plan Comparison (PDF) document.

Retirees may enroll in the CSU Retiree Voluntary Vision Plan within 60 days of retirement. The monthly premium is fully paid by the retiree and is deducted from their retirement check issued by CalPERS. You may also choose to enroll in the VSP Premier plan, which allows for additional benefits, however the premium costs are slightly higher than the VSP Basic plan. To compare the two plans, please review the VSP Summary Plans for retirees.

Upon retirement, a retirement packet with the above-mentioned information will be mailed to your address that we have on file.

-

The difference between gross and net pay differs in retirement than it does for active employees. There are fewer deductions taken. The following are examples of deductions that are NOT taken from retirement checks:

- Social Security Tax

- Medicare Tax

- CalPERS Contributions

- Union Dues

- Parking Fees

- Also, all voluntary deductions cease. This can include life insurance, long term care, credit unions, and charitable contributions. For more information, visit the retiree section of CalPERS Online.

-

CalPERS is coordinated with Social Security which means that you may be eligible for benefits from the retirement system once you are vested and meet the minimum age requirement.

Active employees who reach the age of 65 may enroll in the Premium Free Medicare Part A (Hospital Insurance) but should defer enrollment in Medicare Part B. For more information, please visit CalPERS/Benefits/Medicare.

Visit the Social Security and Medicare websites to learn more about these benefits. You may also use the Retirement Estimator to calculate your social security benefits.

-

Faculty members who are interested in the FERP program should contact Associate Provost, Silvina Ituarte, at silvina.ituarte@csueastbay.edu

-

Understanding Your Retirement Benefit Options

Date: Wednesday, July 10, 2024

Time: 11:00 a.m. (PT)

Duration: 20 minutes

Registration: FreeThe retirement payment option you choose determines the monthly amount you'll receive as a retiree and what your beneficiaries may receive after your death. Having a clear understanding of the retirement payment options is a vital part of planning your retirement. In this video CalPERS will walk you through how to use the myCalPERS service retirement estimate calculator and the different retirement options available to you.

Medicare and Your CalPERS Health Benefits

Date: Wednesday, August 14, 2024

Time: 11:00 a.m. (PT)

Duration: 20 minutes

Registration: FreeHave you ever wondered how Medicare impacts your CalPERS health benefits? Join us in this informative video where we'll cover the different parts of Medicare along with how and when to coordinate with your CalPERS health benefits.Online Service Retirement Application

Date: Wednesday, September 11, 2024

Time: 11:00 a.m. (PT)

Duration: 25 minutes

Registration: FreeThere are a number of benefits to submitting your service retirement application online; it's secure and easy, you can leave the application and return anytime to complete it, you can sign it electronically, and more. In this video, we'll discuss things you may need to do prior to submitting your application. Additionally, CalPERS will provide a step-by-step tutorial of how to fill out your service retirement online application.Register for CalPERS classes here. -

Your W-2 will be sent to the address we have on file. To update your address, you may:

- Submit the change via MyHR using the self-service link, or

- Submit the Employee Action Request via Adobe Sign.

- Login to Adobe Sign

- Select the Home tab

- Select Start from Library

- Select Workflows

- Select HR/Payroll - Employee Action Request

-

To speak with a Retirement Specialist, please contact CalPERS at 1-888-225-7377.

If you would like to rollover your vacation hours into your 401K, 403(b), or 457 plan, you may contact tony.tijero@csueastbay.edu 30-45 days prior to separating from the University.

For questions about FERP, you may contact Associate Provost, Silvina Ituarte, at silvina.ituarte@csueastbay.edu

-

Does the university have a retirement program?

Yes. The California State University (CSU) participates in the CalPERS program. Membership is mandatory for eligible employees. Retirement program eligibility is based on appointment type, duration, full-time equivalency (FTE) and previous public agency or reciprocal agency employment. Retirement formulas vary based on the member’s occupation and their CalPERS membership date.

To qualify for CalPERS membership, employees must be appointed as follows:

- Full-time appointments over six months

- Half-time appointments for one year or longer

- Adjunct Faculty must be appointed at half-time (7.5 units) or higher for three (3) consecutive semesters. Subsequent appointment can be for any units.

Employees excluded from CalPERS membership are covered by the CSU Part-Time Retirement Plan

(PST).

(PST).What does the CSU service retirement program provide?

The service retirement program is a lifetime benefit. If hired prior to January 1, 2013, the employee can retire as early as age 50 with five years of service credit. If the employee became a member on or after January 1, 2013, they must be at least 52 years old to retire.

What is Vesting?

Vesting for health and dental benefits is five years of PERS credited service for employees hired and who established membership on or before June 30, 2017.

There is a vesting requirement of 10 years of membership for Unit 3 (CFA) employees hired on or after July 1, 2017 and 10 years of membership are required for all other units hired on or after July 1, 2018.

How do I earn service credit?

You earn service credit for each year or partial year you work for a CalPERS-covered employer. It accumulates on a fiscal year basis (July 1 through June 30) and is one of the factors used to calculate your future retirement benefits.

How long must I work in a fiscal year to earn a full year of service credit? You must work at least:

- Full time (monthly pay employees): 10 months

- Hourly pay employees: 1,720 hours

Do I have to pay towards the CSU retirement program?

Yes. Employees contribute a percentage of their gross monthly income. Ranging from 5% to 11% based on several factors such as position held and date of employment. Employee contributions are deducted on a pre-tax basis.

What happens to my contributions if I separate from the university without retiring, and?

I am not vested.

Separating employees who are not yet vested with CalPERS, have the option of leaving their contribution on deposit with CalPERS (and continue to earn interest), or withdraw their employee contributions plus interest after separation.

I am vested, but not ready to retire.

Vested employees who separate but are not ready to begin receiving retirement benefits from CalPERS, may choose to retire at a later date. Employee contributions may be left on account with CalPERS until actual retirement. Employees must remember that retiree health care benefits will be lost if the employee does not retire within 120 days of separating from the CSU.

For more information, employees may contact the CalPERS Customer Service Center at (888) 225-7377 or visit CalPERS Online

.

.Do I have to contribute to social security?

It is mandatory for employees contributing to CalPERS to also contribute to Social Security with the exception of Public Safety Officers and a few employees who have been employed with the CSU prior to 1961 and opted out of Social Security. CalPERS benefits are coordinated with Social Security.

When am I eligible for service retirement?

Service retirement is a lifetime benefit. Employees with five years of CalPERS service and hired before January 1, 2013 are eligible to retire at age 50 (or age 52 if hired after January 1, 2013).

Are all CSU retirees eligible for retirement health benefits?

No. You must retire within 120 days of your separation from employment; must have been eligible for enrollment in a CalPERS medical plan on your date of separation; and must receive a retirement allowance from CalPERS.

Are there any health benefit vesting requirements for CSU retirees who meet the health benefit eligibility rules?

Yes, there are vesting requirements. For some CSU bargaining units, if you were hired on or after certain dates you are subject to a 10-year health vesting period for retiree health benefits. Once you reach 10 years of state service, you are fully vested and qualify for 100 percent of the state's contribution towards your health premium.

- Bargaining units and hire dates for 10-year health vesting are as follows:

- Bargaining Unit 3 (Faculty) - July 1, 2017

- Non-represented employees - July 1, 2018

- Bargaining Unit 1, 2, 4, 5, 6, 7, 9 and 10 - July 1, 2018

Does my unused sick leave count towards retirement?

Any unused sick leave is automatically converted to additional service credit if the employee retires within 120 days of separation from employment. Eight hours of sick leave equals one day (.004 of a year of service). It takes 250 days of sick leave to receive one year of service credit (.004 x 250 = 1 year).

What benefits can continue into retirement?

Medical and dental benefits continue into retirement for eligible employees and their dependents. Vision is available under a voluntary plan. The CSU-paid life insurance will end on the separation date.

What will be the monthly out-of-pocket cost for benefits?

The cost of your medical plan will depend on which plan and level of coverage you choose. Generally, retirees pay the same monthly premium as active employees until you and/or your dependents become eligible for Medicare. There is no cost to you for the Basic dental plan. You may wish to enroll in a retiree vision plan for a nominal monthly premium.

Will I have the same coverage as a retiree that I had when I was an active employee?

Medical - Upon your retirement, if you need to, you will be able to change your medical plan. Once you are eligible for Medicare, you will be enrolled in the supplemental to Medicare Plan. Please visit CalPERS/Meicare

for more information.

for more information.Dental - The retiree dental changes to a basic plan with a slight reduction in benefits. The CSU pays 100 percent of the monthly premium cost for basic dental coverage for all eligible retirees and their eligible dependents, which includes a spouse or registered domestic partner and/or children up to age 26.

Retirees have the option to purchase enhanced coverage and pay the difference between the basic coverage and enhanced coverage.

The CSU and Vision Service Plan (VSP) offer you a choice of two vision plans: Basic or Premier. The VSP Premier plan offers a higher level of benefits for lenses, contacts and frames.

For more information on the retiree dental and vision benefits, please visit the CSU Retiree

Page.

Page.Please note: If your retirement date is the 1st through the 10th of the month, your active employee benefits end at the end of that month. If your retirement date is the 11th through the 31st of the month, your active employee benefits end at the end of the following month.

I am currently enrolled in a CalPERS medical plan. What do I do to obtain retiree medical coverage?

If your retirement date is within 30 days of your separation date you will not need to do anything. If your retirement date is more than 30 days and less than 120 days from your separation date, you need to contact CalPERS at (888) 225-7377 to enroll in medical.

What do I do when I (or a dependent) become eligible for Medicare?

You and your dependents must certify your Medicare status with CalPERS when you each become eligible for Medicare. At that time, you will need to choose a Medicare supplement plan. Visit the CalPERS

website or call 888-225-7377 to change your plan.

website or call 888-225-7377 to change your plan.How does my dental coverage change?

Once you retire, your dental coverage will change from the Enhanced level of coverage to the Basic level (does not apply to FERP participants). Shortly after your separation you will receive information regarding the change.

What will the monthly out-of-pocket cost be for retiree dental coverage?

Currently, the CSU pays the full cost of the Basic dental coverage for eligible retirees and their dependents.

I am currently enrolled in FlexCash. How do I enroll in a retiree plan?

FlexCash participants may request health coverage within 30 days before or 60 days after retirement. To enroll before your retirement date, contact our Benefits Office at 885-3634. To enroll after your retirement date, contact CalPERS at 888-225-7377 . You may also enroll during any subsequent open enrollment period.

Can I change my health plans and add or delete dependents?

You may change your plans and add or delete dependents during the annual open enrollment period or within 60 days of a qualifying event.

I am ready to retire, who do I notify?

Prior to retirement, employees should notify their MPP administrator and complete the University's separation clearance process.

Once retired, who do I contact with benefit-related questions or concerns?

Contact CalPERS directly at 888-225-7377 .